S.F.’s hotel pain could spread as more than 30 owners face mortgage deadlines

S.F.’s hotel pain could spread as more than 30 owners face mortgage deadlines

By: Roland Li | June 7, 2023

Park Hotels & Resorts’ plan to surrender ownership of two of San Francisco’s biggest hotels reflects the city’s slow tourism recovery and the widening financial distress hitting local property owners.

The company plans to give up nearly 3,000 hotel rooms in the Hilton San Francisco Union Square and Parc 55 properties. Its expected $725 million loan default appears to be the largest U.S. hotel default during the pandemic.

Though unmatched in size, Park Hotels is far from alone.

Other San Francisco hotels such as the Huntington on Nob Hill and Yotel on Market Street were recently sold in foreclosure auctions.

And more than 30 additional San Francisco hotels are facing loans due in the next two years, said Emmy Hise, senior director of hospitality analytics at CoStar, a real estate data firm.

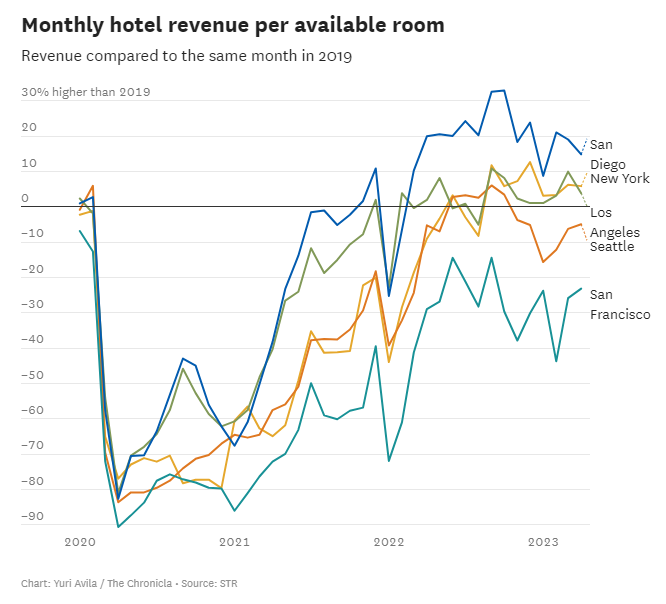

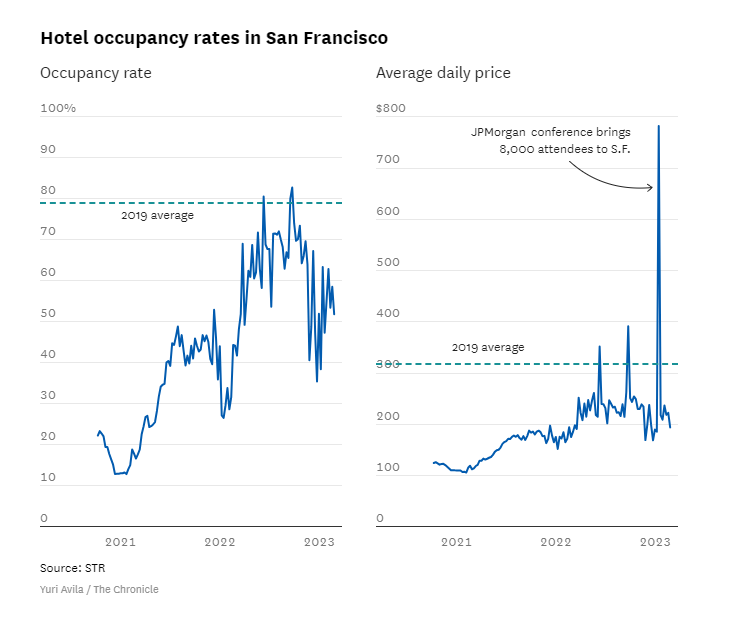

San Francisco has one of the slowest pandemic recoveries in the country, and its daily room rate of $234 in the past year is below 2019 levels, Hise said. Every other U.S. market is above 2019 levels, in part because of inflation.

The city’s highest-spending leisure tourists were from China, and those travelers were barred from returning until the Chinese government ended its strict border policies earlier this year. Corporate travel is also getting cut as tech firms conduct mass layoffs and try to reduce costs, Hise said.

Higher interest rates are also making it harder for owners to refinance.

After Park Hotels, the next-biggest mortgage deadline comes in January 2024, when the Hilton San Francisco Financial District on Kearny Street faces a $97 million loan maturation.

As of March, just $9.3 million of the loan has been paid off, according to filings by owner Portsmouth Square Inc., a subsidiary of InterGroup Corp.

“We are confident that we can achieve the refinancing of this loan,” said David Gonzalez, president of Portsmouth Square Inc. He said business has been strong and the hotel has outperformed its neighbors, making it a “very different animal” from Park Hotels’ properties, which coincidentally are also branded as Hilton hotels. (Park Hotels itself was spun off from Hilton Worldwide in 2017.)

Gonzalez said his hotel’s location in the Financial District on the border of Chinatown, compared to the close proximity of Park Hotels’ properties to the Tenderloin, “makes a world of difference” as well.

The 543-room Hilton Financial District hotel was 78% occupied in the first quarter of this year, with an average daily rate of $234. The hotel had a $680,000 loss in the first quarter, compared with a loss of $2.47 million in the first quarter of 2022.

Gonzalez noted the hotel was profitable in the first quarter if depreciation and amortization costs of $693,000 are excluded.

Park Hotels’ four San Francisco hotels were only 48% occupied in the first quarter, the second-lowest among its regions. (It also owns the JW Marriott Union Square and the 316-room Hyatt Centric Fisherman’s Wharf.) Hawaii, the company’s fullest region, was 88% occupied during that period.

Hilton Union Square was closed for more than a year and Parc 55 was closed for two years at the start of the pandemic, and revenue plunged.

In 2019, the hotels had a combined $354 million in revenue and 92% occupancy, according to figures provided by Alan Reay, president of Atlas Hospitality Group, a hotel consultancy. Revenue dropped to $73 million in 2020, $29 million in 2021 and $145 million in 2022.

Park Hotels confirmed the two hotels would remain open amid any ownership change this year and declined to comment further.

Workers also have contract protections.

“Hotel workers at the Hilton Union Square and Parc 55 will not be affected by any change in the ownership of their hotels. These sales are frequent in the hotel industry, so our union has secured contract language that requires hotel owners and operators to retain staff in the event of a transfer and to negotiate with our union about any impact on workers,” said Anand Singh, president of Unite Here Local 2, which represents hotel workers, in a statement. “The economic performance of the hotels is consistent with other large ones in the city. Around 75% of the union’s over 15,000 members are back to work, with food and beverage staff the slowest to return.”

Reay said that potential buyers of the hotels could see an opportunity in turning them into housing.

“Hotels are a lot easier and not as costly to convert as office buildings. Apartment conversion would have much lower expense on operating as there are a lot fewer employees required and better cash flow based on current hotel metrics,” he said.

But such a project would require city approvals, and, much like hotel rates, San Francisco apartment rents have also stagnated due to lower demand.

Park Hotels CEO Thomas Baltimore Jr. cited weaker-than-expected convention bookings at Moscone Center, a slow return to the office and street conditions as factors clouding San Francisco’s path to recovery.

There’s also a seemingly relentless barrage of negative news about stores closing — including two Nordstrom stores shuttering a block from Parc 55 — and crime, including a fatal shooting outside Walgreens nearby.

The stories reflect major challenges for San Francisco. And they could discourage leisure travels and businesses from visiting the city, Hise said.

“Most downtowns are struggling with this issue” around negative perception, she said. “San Francisco has been getting a lot of the national press.”

Numerous hotels around the country, from Portland, Ore., to Minneapolis to New York, have also gone into foreclosure in the past year.

There are bright spots: The city is hosting the Asia-Pacific Economic Cooperation, a high-profile forum for world leaders, at the end of the year. Levi’s Stadium in Santa Clara is hosting the 2026 Super Bowl and a portion of the 2026 World Cup, which is expected to boost tourism around the Bay Area.

San Francisco Travel also started a $6 million ad campaign last month to highlight the city’s attractions.

“I think it’s tough right now,” Hise said. “I think that there’s positive aspects.”

Reach Roland Li: roland.li@sfchronicle.com; Twitter: @rolandlisf