Bullish Los Angeles beckons hotel investors

Bullish Los Angeles beckons hotel investors

BY STEFANI C. O’CONNOR | FEBRUARY 13, 2024

Politics, economics, taxes, lending environment shape lodging landscape in the City of Angels.

LOS ANGELES — As a city bullish on enhancing itself as a tourist mecca — ostensibly to ensure its lodging base flourishes—Los Angeles as a destination for hotel investors presents more as a mix of select opportunities and potential red flags.

On one hand, market confidence-builders include a phased [ongoing] $30 billion investment to modernize Los Angeles International Airport (LAX); the opening this year of the L.A. Clippers new home, the Intuit Dome; the debut next year of the [George] Lucas Museum of Narrative Art; and subsequently, the FIFA World Cup and NBA All-Star Game (2026); Super Bowl LXI (2027); and the Summer Olympic and Paralympic Games (2028).

In contrast, area politics and economics have been among key concerns for both existing and potential hotel investors of late, as much of it toggles to alleviating the plight of the homeless and broadening the scope of affordable housing in L.A.

“Los Angeles, other than downtown, has been a historically under-supplied market; barriers to new supply are much higher today,” said Daniel Peek, president and chief operating officer at Hodges Ward Elliott. He cited homelessness and “street” issues as “a huge challenge to attracting equity capital to L.A., not just for hotels but more broadly. A more fulsome political response is necessary to address the shortcomings of recent administrations.

Last year on April 1, the city enacted Measure ULA (United to House L.A.), an all-property real estate transfer tax known locally as the “mansion tax.” Formally known as the Homelessness and Housing Solutions Tax, it adds a 4% tax on top of an existing 0.56% base transfer tax imposed by the city (0.45%) and county (0.11%) on commercial and residential property sales priced/valued at $5 million to less than $10 million and adds a 5.5% transfer tax to property sales priced/valued at $10 million or more. It also significantly boosts one of the key cost components of such transactions executed in Los Angeles, with the seller responsible for paying the mansion tax.

“The main challenge is still the increased cost of hotel loans and the number of lenders that have pulled out of the lending market,” said Alan Reay, president of Atlas Hospitality Group. “Sellers have to first adjust their price expectations to meet the new higher cost of debt. Second, the mansion tax is having a huge negative impact on dispositions/acquisitions.”

Transaction expectations

Reay indicated private equity and individual hotel owners would be the most active buyers in the months ahead. “Private equity has raised a lot of funds in anticipation of a wave of distress deals hitting the market,” he said.

“Los Angeles transaction volume was depressed in 2023 and mirrored the transaction environment nationally,” observed James Reivitis, head of Development and managing director for Access Point Financial. “We would expect large, big-box hotels to continue to be challenging to underwrite in the Los Angeles market.”

Reivitis does foresee L.A. transaction volume increasing, largely stemming from existing debt maturities, the PIP/capex needs of underinvested hotels and the anticipation of declining interest rates. “We primarily expect this activity to come from private equity and multi-unit hotels owners,” he said.

Political challenges

On another front, hotel owners and those with vested interests in the market’s hotels have been pushing back for months against a measure championed by the L.A. hospitality workers union, Unite Here Local 11, that basically called for hotels to house the homeless alongside paying guests. The initiative was slated for a March 5 ballot.

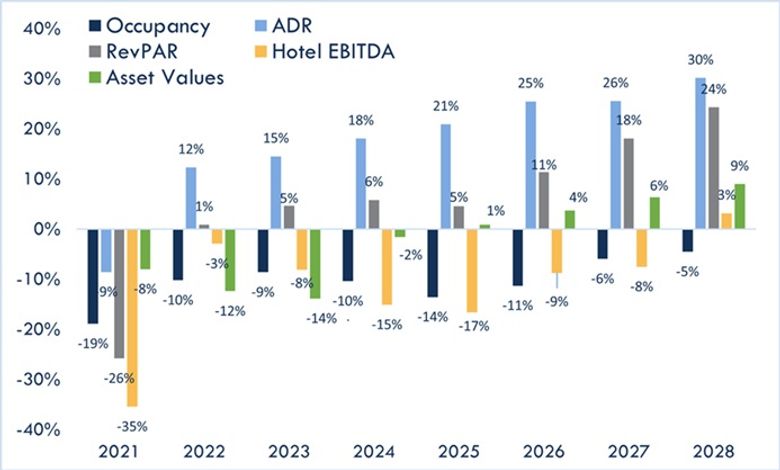

Los Angeles market performance relative to 2019 levels (source LARC)

In December, however, the L.A. City Council voted to approve Local 11’s request to withdraw its measure from the ballot after the council, the union and area hoteliers crafted a compromise ordinance—the Responsible Hotel Ordinance (RHO)—that includes a voluntary outreach program that would have hotels register with the city and notify it when vacant rooms are available to accommodate the homeless.

Hotel developers also will be affected. RHO’s requirements include obtaining a permit from the Department of City Planning, a public review of the proposed project vis-a-vis impact on area housing, as well as one-for-one replacement of housing demolished or converted to accommodate the project. According to the ordinance, this could take “the form of new construction of residential dwelling units or acquisition and rehabilitation of existing vacant market-rate residential dwelling units.”

By the numbers

The number of hotels currently in construction in Los Angeles stands at 17, according to CoStar data, representing some 2,090 rooms. There are 41 in final planning (7,083 rooms) and 50 (7,170 rooms) in the planning stage. Fourteen properties representing 1,685 rooms are projected to open this year. These include a variety from the big brands, as well as five independents, and range in location from Burbank to Valencia.

According to John Strauss, senior managing director of JLL’s Hotels & Hospitality group, lack of construction debt given the high-interest-rate environment will stymie new development for the short to medium term. “We will see new hotel development well below a 2% annual average increase for the foreseeable future,” he said. “On the surface that’s a negative for developers, but this benign supply picture should bolster the investment thesis for hotels and CRE (corporate real estate), generally for investors to invest opportunistically in the space today. Lack of reasonably priced acquisition financing is and will impact valuations negatively and lead to pockets of distress should rates not abate as the market is currently pricing into levered analyses.”

Rendering of the Welcome Group’s AC by Marriott development in Pasadena

Last year, JLL Capital Markets arranged $36.8 million in construction financing for 550-566 E. Colorado Blvd., a 194-key, six-story hotel development in the Playhouse District of Pasadena. The project is coming out of the ground via L.A.-based Welcome Group and is slated to operate as an AC by Marriott when it opens next year.

Strauss said deals in the $25- to $75-million range are attracting attention from high-net-worth families, offshore investors and select hotel REITS along with “hotel assets located in high-barrier-to-entry locations that are cash flowing and, therefore, attracting debt financing more easily.”

New development scenarios

As it pertains to development, there is considerable concern tied to policy unfolding across the Los Angeles market, according to Ryan Meliker, president and co-founder of Lodging Analytics Research & Consulting (LARC). “Whether that be in the form of required affordable housing development or use cases pertaining to vacant hotel rooms or property tax increases or how/if/when the city will clean up the unhoused population issues. These risks are greatest downtown and within the City of Los Angeles rather than in the county but are risks across the whole market.”

Peek said mixed-use will likely be the key to projects being developed at all. “The challenges of replacement cost and the cost of capital (interest rates) will result in very limited new development,” he said. “The conceptual ‘subsidy’ presented by mixed-use may be the key to new development, [although] office as a component of such redevelopment will be more difficult today.”

Several industry veterans cited areas of opportunity within the L.A. market, notably Beverly Hills, Santa Monica and West Hollywood. Frank Nardozza, chairman and CEO of REH Capital Partners, noted his investor partners are looking for “highly opportunistic deals suffering financial pain, assets with redevelopment potential to add residential or to be significantly repositioned.”

Nardozza indicated luxury deals were getting done, particularly in West Hollywood or near L.A.’s beaches, while extended-stay and select-service were “everywhere.”

Nardozza added REHCP is working on a boutique mixed-use hotel/residential project in West Hollywood and there are a few large deals coming down the pike in Beverly Hills, Santa Monica and West Hollywood.

“Mid-2024 will be the real barometer to see if there is material movement by the Fed to cut rates. If rates come down by 100 basis points there will be great optimism as FOMO kicks in once the first couple of large deals get done in L.A.,” Nardozza said.

Peek added that his firm has always been big believers in the west side—Santa Monica, Century City, West Hollywood. “Downtown has clearly struggled given new supply, the well-reported street issue, the slow return to office, impacted transient, leisure [business], etc.,” he said. “We are very confident that well-located extended-stay and select-service can and will outperform. Separately, the pricing power of the luxury market in Beverly Hills and Santa Monica may present a unique investment opportunity.”

Jeff Altman, senior managing director in JLL’s M&A and Corporate Advisory team, said he does expect to see more M&A activity. “Consistent with other property sectors, recent stock-for-stock transactions and select take-private opportunities have been well received by the market,” he said. “Also, similar to other property sectors, there are numerous sub-scale non differentiated REITs that would be well served to merge or sell.”

LARC’s Meliker expects the strongest growth in fundamentals will be in Santa Monica, Beverly Hills and Hollywood. “However, these are also the most expensive areas of the market. We expect growth to be intriguing by SoFi Stadium and LAX as well, while we are most cautious downtown where we see more risks than upside,” he said.